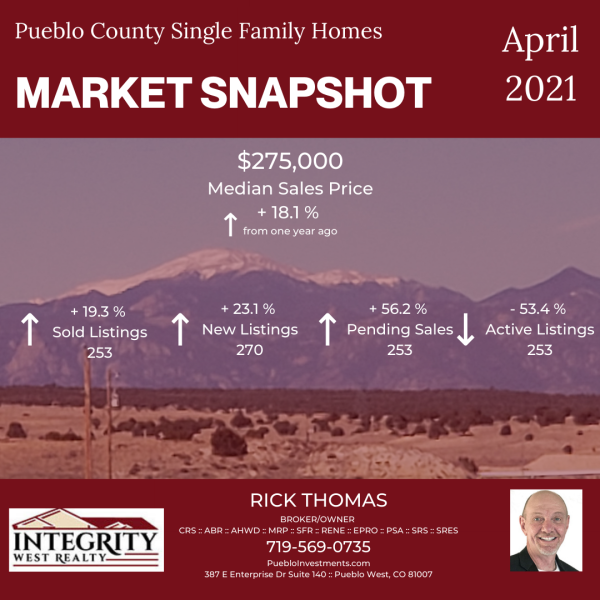

Pueblo County Real Estate Market Trends – February 2023

On February 23, 2023 the Federal Reserve raised it’s short term interest rate by a quarter percentage point bringing the federal funds rate to a range of 4.75 % to 5%. In anticipation of the rate hike the yield on the 10 year treasury notes dipped to 3.4% on Monday, February 20, 2023. At…

Read the full article…